What A Bookkeeper *Actually* Does All Day

Have you ever wondered what a bookkeeper really does all day?

Like, is it just spreadsheets and calculators... or is there something more?

If you’ve ever wanted to start a bookkeeping business, this post gives you a behind-the-scenes look at what my real workday is like. I’m a bookkeeping business owner working part-time while raising two kids. I’ll walk you through my exact daily routine, including how I categorize transactions in QuickBooks Online. You’ll also see which bookkeeper tasks I do weekly and monthly, and how I stay organized. Whether you're just getting started or already working with clients, you’ll see what a bookkeeper does on a typical day. I’ll share my time-saving tips, my personal system, and a look at my 4-hour workday.

Whether you’re already a bookkeeper, thinking about becoming one, or just trying to understand the role for your own business—this will give you a practical, inside look at what bookkeeping really looks like.

Watch the video here, or keep reading!

What We Do:

1. Categorizing Income and Expenses (This is the Core!)

This is where every bookkeeper starts.

Your job is to track every dollar coming in and going out of a client’s business. Why? Because come tax time, the IRS (and your client’s accountant) will want to know exactly where that money went—how much was spent on meals, payroll, software, rent, and so on.

To do this, you’ll connect your client’s bank accounts and credit cards to QuickBooks Online (QBO). Every transaction flows in, and then you assign it to the right category—using something called the Chart of Accounts.

QBO gives you some default categories, but you can customize them based on your client’s business. For example, one of my florist clients buys both flowers and tools like clippers and vases. I customized her chart to separate those costs so her reports are more useful.

Once categorized, I like to open the profit and loss report and click into each section to double-check everything makes sense—especially for smaller clients.

At the end of each month, you’ll reconcile each bank account to make sure QBO matches the actual bank statement. This is the heartbeat of bookkeeping—it’s how you catch errors, missed transactions, or duplicates.

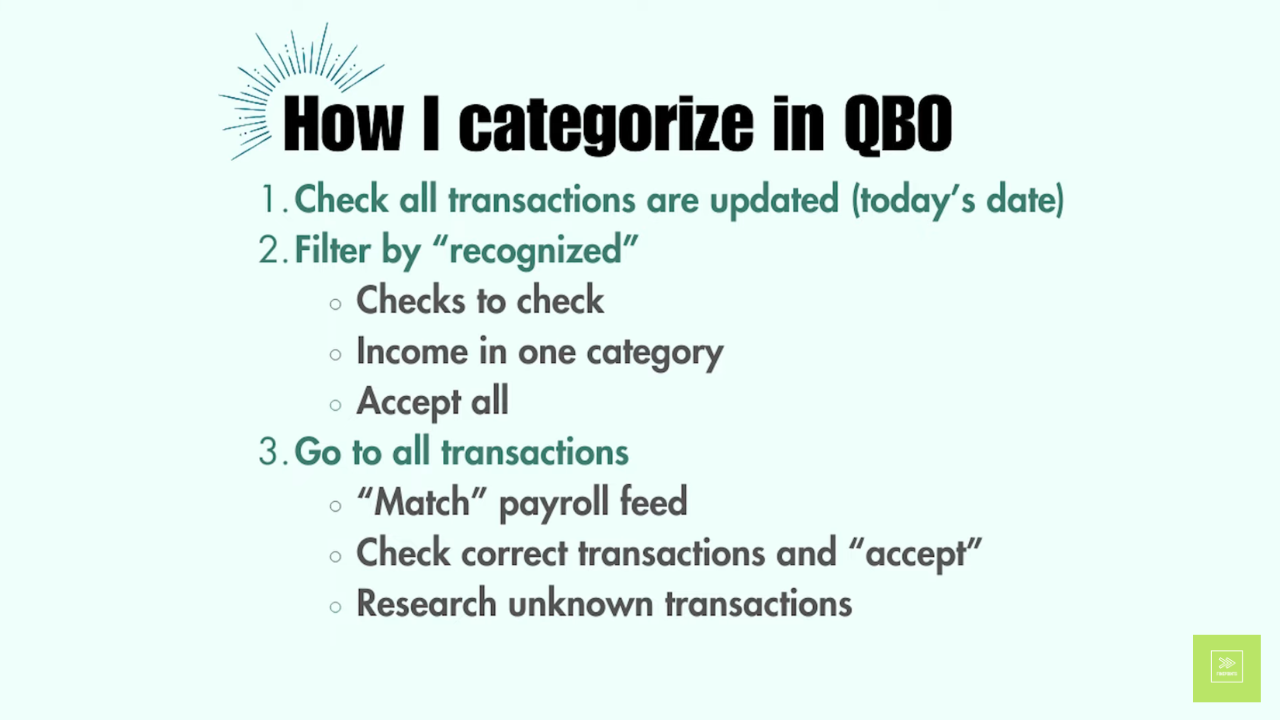

Quick Tip: Start by reviewing "Recognized Transactions" in QBO. Sort by description, bulk select, and uncheck anything that needs further review. If something looks off, you can investigate and fix it before finalizing.

Learn more about the Chart of Accounts in this video: What's the Chart Of Accounts? How to set up in QuickBooks Online

2. Accounts Payable (a.k.a. Bills)

If your client needs help paying bills, that’s called accounts payable.

You might:

Track vendor invoices

Enter bills into QBO

Pay bills manually or using a bill-pay system

Some clients send paper bills, others prefer digital. I’ve had clients drop off paper bills with handwritten notes and check stubs—yes, real paper! So part of my day might include inputting 60+ checks, then matching them to what fed into the bank to make sure it all reconciles.

It’s up to you (and your client) to decide what system works best.

Learn more about Accounts Payable with this video: Pay Bills in QBO (accounts payable workflow for bookkeepers)

3. Accounts Receivable (a.k.a. Invoicing + Getting Paid)

On the flip side, your client needs to get paid—and that’s where invoicing comes in.

Many service-based businesses (plumbers, coaches, therapists, etc.) need help sending invoices and tracking who’s paid.

As the bookkeeper, you’ll:

Create and send invoices in QBO

Track outstanding balances

Send follow-up reminders

Mark invoices as paid once money comes in

I also help one client track how much income each employee generates—so I use a ledger they provide to input revenue per person and reflect that detail in the reports.

Learn more about Accounts Recievable with this video: How to create an INVOICE and receive payments in QuickBooks Online

4. Payroll (It’s Optional—But Common)

Not every bookkeeper handles payroll. But it’s a great service to offer.

You might input employee hours, communicate with a payroll provider, or even run payroll yourself through QuickBooks. Personally, I love when my clients use a separate payroll service (because taxes + laws = too many moving parts).

But either way, your role is to:

Collect employee hours

Coordinate with the payroll provider

Enter payroll reports into QBO

Make sure payroll expenses are categorized correctly

For small businesses, having you manage this is a huge relief.

Learn more about Payroll here: Should you do PAYROLL as a bookkeeper?

5. Preparing Monthly Financial Statements

This is where the numbers come together and actually make sense.

Each month, after reconciling and categorizing everything, you’ll create financial reports for your client—typically:

Profit & Loss Statement (Income at the top, expenses below)

Balance Sheet (Assets, liabilities, and equity)

Accounts Receivable Reports (Who owes what)

I usually send these around the 6th of each month. One client prefers seeing the last three months side-by-side, while another just wants year-to-date totals. Report preferences will vary from one client to another.

If the business is small, I’ll even go into each category to double-check what’s there—just to make sure everything’s in the right place.

Learn about Profit and Loss statements here: Profit and Loss Statement: for beginners

Learn about reports a bookkeeper provides in this video: What to expect from my bookkeeper each month

6. Year-End Activities (Partnering With the Accountant)

While bookkeepers don’t usually file taxes (that’s what a CPA or tax preparer does), you’ll play a critical role in helping your client get ready.

This includes:

Sending year-end Profit & Loss and Balance Sheet reports

Providing payroll summaries or depreciation records

Answering accountant questions

Some accountants need specific reports or access to QBO. I’ll often add them directly so they can pull what they need. It’s a partnership.

Here is how I do it: How to do "year end" bookkeeping

Breaking Those Down: Levels of Bookkeeping Services

Here’s a breakdown of common bookkeeping services by skill level:

LEVEL 1 (Basics - Start Here) LEVEL 2 (Intermediate) LEVEL 3 (Advanced)

✔ Categorizing Transactions ✔ Paying Client Bills ✔ Payroll (Manual Setup)

✔ Reconciling Bank Accounts ✔ Invoicing Client Customers ✔ Inventory Management

✔ Sending Reports to Clients ✔ Cleanup Work

If you’re starting out, focus on Level 1 tasks. As you build confidence and experience, you can expand to more advanced services.

Looking for more detail? BEGINNER services to offer as a bookkeeper (level 1, 2 and 3 ideas)

Real Life: What a Day Might Look Like

One of the best parts about bookkeeping? Flexibility.

I typically work part-time, about 9:00 a.m. to 1:00 p.m., while my kids are in school. My night-before routine includes setting a simple 3-item to-do list to keep me focused. Most of my tasks involve working in QuickBooks, answering client questions, and making YouTube videos.

Here’s what my day might include:

Categorizing transactions and reconciling accounts

Sending invoices (including my own—don’t forget to get paid!)

Texting a fellow bookkeeper to check in or collaborate

Updating my business license

Meeting with clients as requested (instead of setting standing meetings)

Troubleshooting QBO sync issues or bank feed delays

Every day looks a little different—but there's a rhythm to it.

I have a whole playlist of Day In The Life videos: "Day in the life" of a bookkeeper (DITL)

Rhythms: What Weeks and Months Look Like

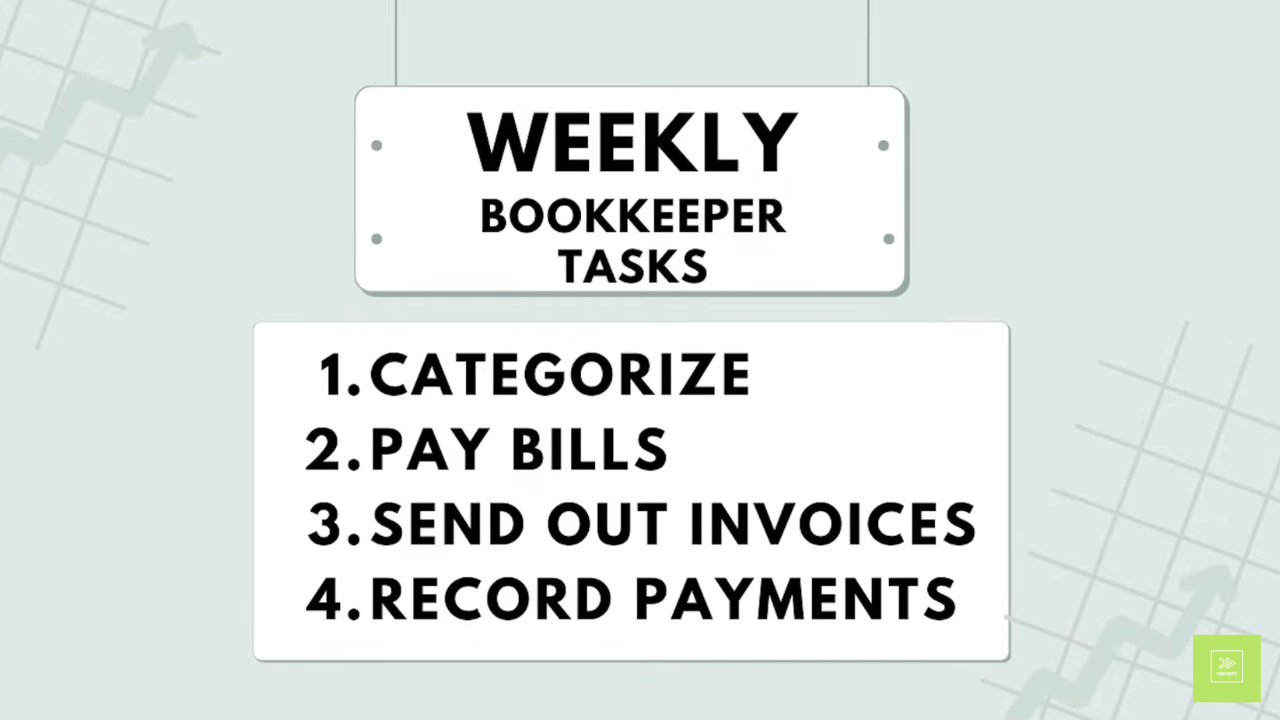

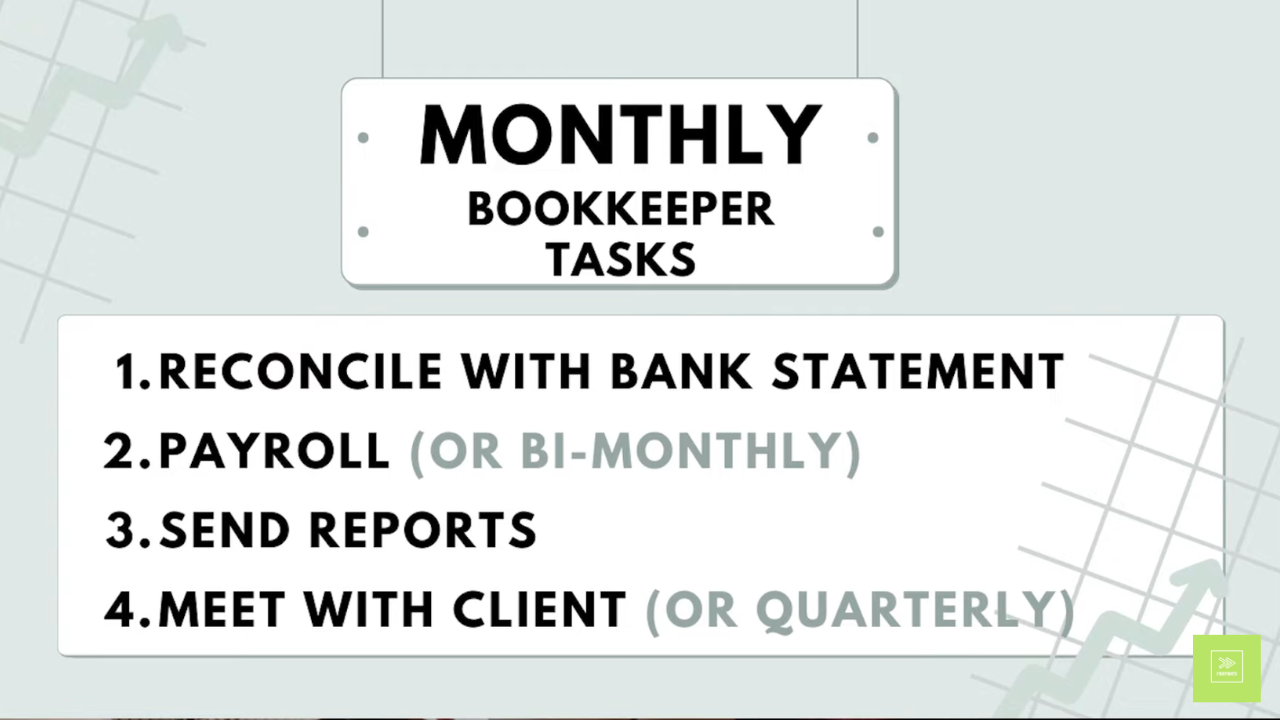

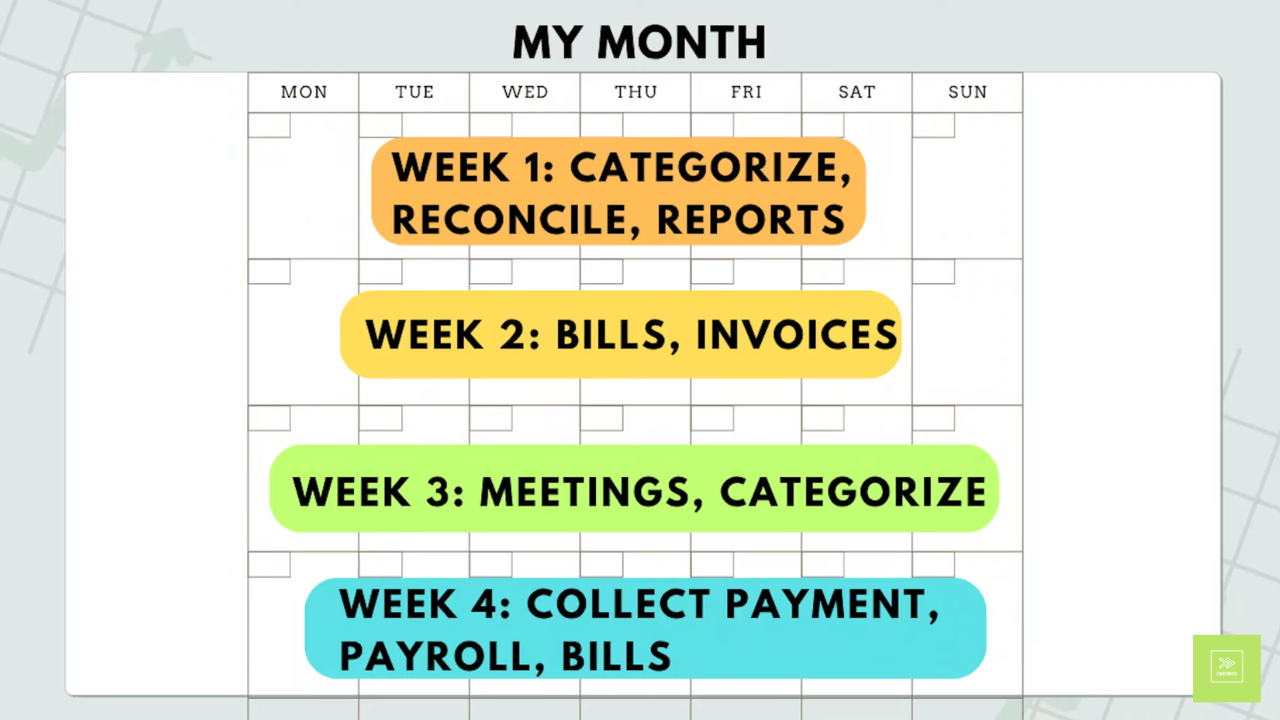

Some tasks happen weekly. Others are monthly. Here’s how I break it down:

I usually divide my tasks into what I do each week of the month.

This rhythm keeps things varied—and helps manage my time efficiently.

Want to Become a Bookkeeper?

If this sounds like your dream job, here are your first few steps:

Start researching the field – Check out my Beginner Bookkeeping Masterclass.

Sign up for QuickBooks Online Accountant – It’s free and includes a sample company so you can practice.

Use my free checklist – Start your bookkeeping business the right way.

And if you're wondering how much to charge? I go deep on that right here.

Bookkeeping is so much more than plugging numbers into a spreadsheet. You’re helping small business owners make sense of their finances—and giving them peace of mind.

It’s flexible, profitable, and deeply rewarding.

If you’re curious about whether bookkeeping is a good fit for you, check out the resources below and start exploring. You’ve got this.

RESOURCES MENTIONED IN VIDEO:

Do you want monthly tips to grow your bookkeeping business?

Join the FinePoints Newsletter